The London Credit Fund continues to demonstrate consistency, resilience, and reliability – hallmarks that have positioned the London Credit Fund as a standout in the alternative investment space. In May 2025, performance across all compartments once again exceeded annualised targets, reinforcing investor confidence and validating the strength of the Fund’s strategy.

London Credit Fund Performance Update

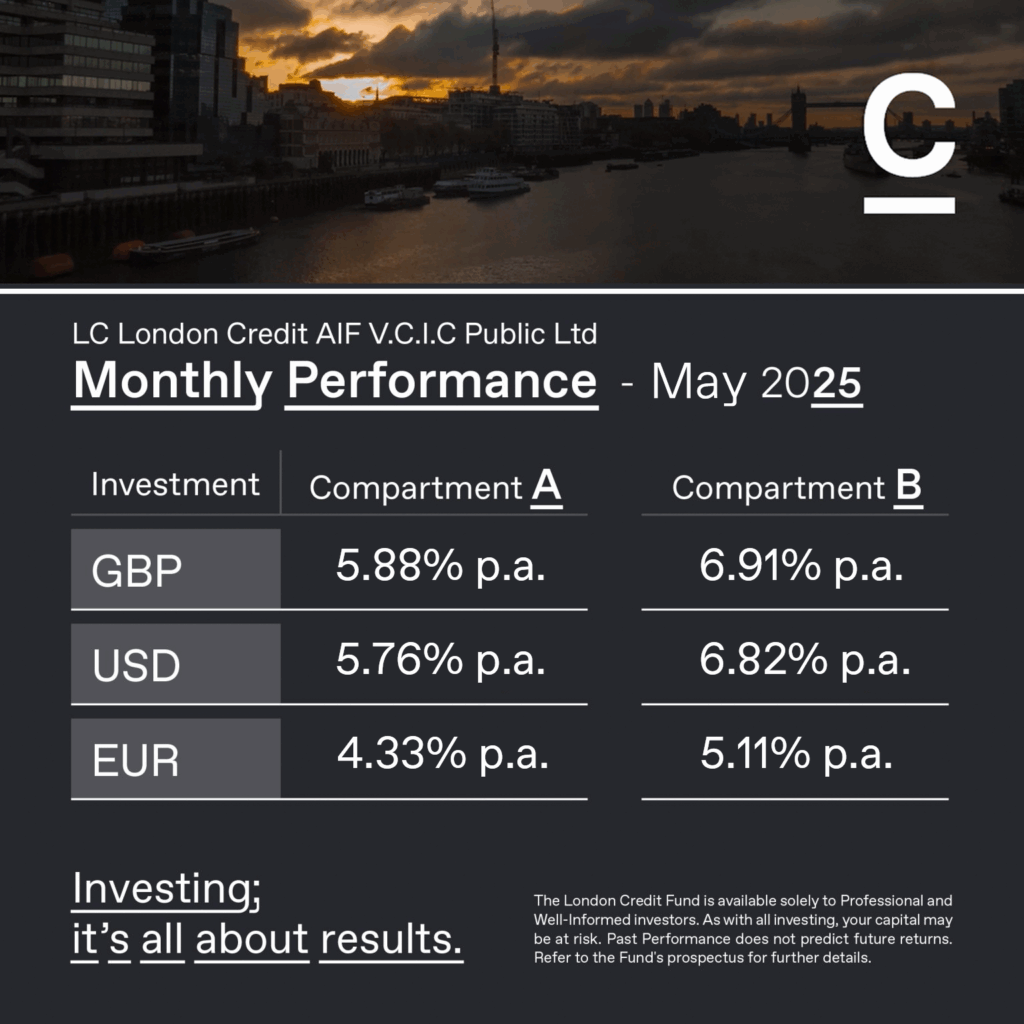

May 2025 Performance Highlights

Investment Compartment A – Secured predominantly against residential properties

- 5.88% p.a. in GBP

- 5.76% p.a. in USD

- 4.33% p.a. in EUR

Each currency class outperformed its respective target returns, with the GBP and USD share classes delivering nearly a full percentage point above their annualised targets.

Investment Compartment B – Secured predominantly against commercial properties

- 6.91% p.a. in GBP

- 6.82% p.a. in USD

- 5.11% p.a. in EUR

Meanwhile, Compartment B has once again surpassed its annualised target returns across all currencies, continuing to deliver premium performance for investors seeking higher-yield opportunities.

Strategic Resilience Amid Market Volatility

The London Credit Fund’s ability to maintain strong performance is underpinned by its prudent asset selection, disciplined underwriting and exclusive focus on short-term loans secured by UK real estate. In an environment where market volatility and rate fluctuations persist, our results reflect the conservative-yet-targeted positioning of the portfolio.

Fund Profile

- Launched: 2021

- Investor Profile: Designed exclusively for professional and well-informed investors

- Underlying Assets: Short-term loans secured by real estate in London and the wider UK market

Interested in learning more about our investment approach or how the London Credit Fund can fit into your portfolio?

Get in touch with our team today:

info@consulco.com

+357 22 361 300

London Credit Fund Performance Update

[LC London Credit AIF V.C.I.C. Public Ltd (“London Credit Fund”) – Licence Number: AIF50/2018]