We are proud to announce that Consulco and our LC London Credit AIF V.C.I.C. has reached the annualised target net return of 4% p.a.

Since the official launch of the fund, back in December 2020, the Assets Under Management (AUM) have exceeded the benchmark of €10 Million and the performance of the fund faces a steady growth, reaching the annualised target return in a period of 9 months.

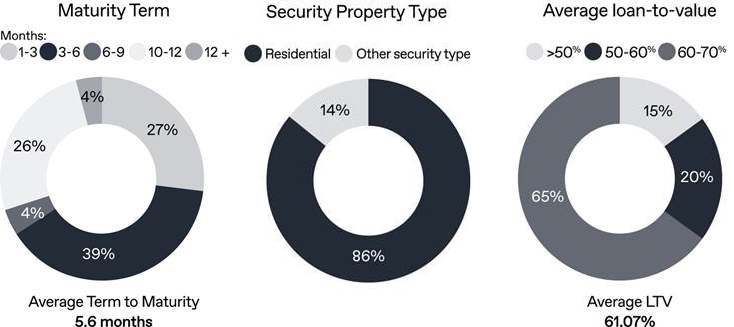

It is of a great importance to highlight the fact that the diversification and the safety cushion that the low Loan-to-Value (LTV) provides are kept at least satisfactory levels with an average term to maturity of 5.6 months, an average LTV of 61.07%, and focusing only on Residential and Commercial Security properties, with 86% and 14% respectively in the portfolio.

An investment option that provides both stability and security.

London Credit Fund invests in short and medium-term business loans mediated in the UK and secured against London real estate through its subsidiaries.

The London Credit Fund has a minimum investment amount of €125,000 and a minimum lock-up term of 12 months.

Redemptions are made monthly with a six-month notice, but dividends are paid quarterly. KPMG serves as the fund’s administrator, while Eurobank serves as the depositary bank. It is worth noting that BDO Cyprus has been named as the external auditor.

The underlying bridging loans described above are originated, underwritten, structured, and prefunded by London Credit Ltd, a UK business and subsidiary of Consulco, a well-established and ten-year experienced London-based short-term lender. For the sake of completeness, it should be noted that London Credit Ltd retains loan administration during the whole loan duration until their full settlement.

Until today, London Credit Ltd facilitated more than 135 million GBP worth of loans, achieving an impeccable performance.