UK, and especially London property, has long been viewed as an attractive, safe, and profitable investment opportunity for foreign investors. More and more sophisticated investors are going for mid to long-term investments in UK property.

London has been the hub of culture and finance for hundreds of years. The city has seen incredible growth in the recent years, both from private and government interventions. Demand for housing from both locals and international investors pushing prices up in all price ranges.

London is the first investment destination in the commercial and residential real estate sector, and a safe haven for real estate investment due to its economic components, political position, and legislative climate. Therefore, it remains stable despite the successive setbacks it is going through, which if another country went through, it would witness a clear stumble, and a real deterioration. – (Arab times, October 2022).

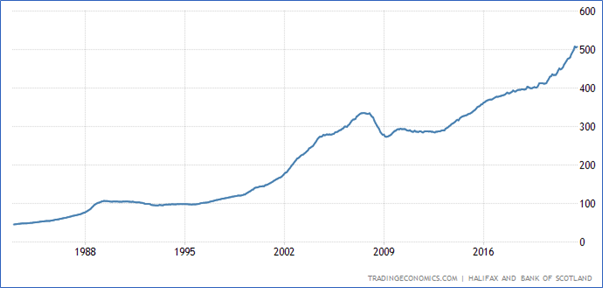

In the long term, UK housing will always recover just as it did with the Global Financial Crisis in 2008-2009, the Brexit referendum and recently Covid-19. Investors understand that the UK and London is a very attractive Real Estate Investment destination and in the long term, they are expected a relatively attractive return based on the risk.

New figures published in 2022 by the City of London corporation, show that London continues to hold the top spot in attracting foreign investment in financial and professional services, attracting 114 projects in 2021 – well clear of Dubai (104 projects), Singapore (104 projects), New York (54) and Paris (51).

In addition, research found that overall, the UK attracted £1.1bn worth of investment in 2021, largest number of financial and professional services foreign direct investment projects in Europe, and second in the world only to the US.

“The UK’s offer to global investors continues to go from strength to strength due to its unique combination of time zone, language, legal system, global talent, transparency, and financial services ecosystem. Our position at the crossroads of Europe’s biggest financial and tech sectors make us one of the globe’s foremost hubs for innovation” (Lord Mayor of the City of London, Vince Keaveny, April 2022) Source: City of London

London as the Global Capital:

- Global Financial Centre Index (September 2022) – London ranks 2nd

- The US and UK remain the leaders in university rankings

- Global Innovative Index Report (2022) – United Kingdom ranks 4th in the world

- English language is the global language of finance, business, accounting, and academia, which is spoken at a useful level by 2bn people

- KPMG Technology Industry Innovation Survey (2022) ranks London 5th

- The World Bank Group ranks as the 8th most business-friendly country

- The Global Financial Centers Index ranked London 2nd

Summary:

London is seen as one of the most attractive cities in the world, in terms of living, working, visiting and most importantly investing. This has never changed throughout the years, even with crisis such as the late 1980’s – early 1990’s crisis as well as the GFC in 2008-2009. In the long term, real estate assets outperform all other classes. (Source: MSCI)

The decline of the pound sterling would create many opportunities in a number of sectors, with the benefit being in the medium and long term. “If we look at the UK economy, the most prominent sectors revolve around the services and real estate sectors, and therefore we see that most of the opportunities that will result from this decline are in these two sectors.” (CEO, Kamco Invest, 2022)

The real estate sector in the UK in all its categories, whether commercial, investment or residential, has maintained its position during the challenges that the markets have experienced, especially during the past years, which indicates that it will become more attractive, especially for foreign investors. Even though the market is currently facing inflationary issues, hence the interest rate increases, UK and especially London real estate has always recovered achieving all-time highs over the long term.

Stavros Aristodemou

Financial Analyst, Consulco