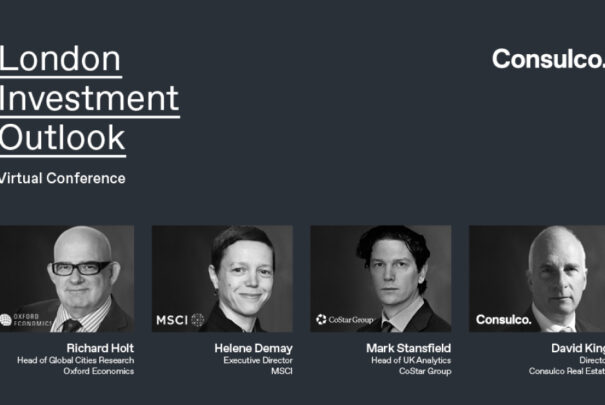

Last month, Consulco hosted its first virtual London real estate conference. The conference was presented by television presenter Mrs. Melanie Steliou, and the event was attended by over 300 investors and professional advisors.

Consulco invited speakers from the top three London research organisations who provided their analysis about the London economy and the impact of Covid-19 and Brexit on the real estate sector. Following these presentations, the audience had the opportunity to receive feedback from Consulco Real Estate, its London-based property advisory company, on the risks and opportunities presented by the current situation.

Oxford Economics is a leader in global forecasting and quantitative analysis servicing international corporations, financial institutions and government organisations. Mr. Richard Holt, Head of Global Cities Research, provided an analysis of the economic impact of Covid-19 on the UK.

Mr. Holt highlighted the substantial impact the pandemic has had on London. However, it was also noted that although hospitality, tourism, cultural events and parts of retail have been hard-hit, these are not the major drivers of GDP growth in London. In fact, London is an extreme example of a city that has benefitted from strength in precisely those sectors that have been able to work from home: professional, advisory, digital and financial services. Finally, Mr. Holt discussed his company’s forecasts for London and the UK which demonstrate a strong recovery in 2021.

Mrs. Helene Demay, Executive Director at MSCI, presented her company’s analysis of property returns over the past 10 years, and focused over the previous 12 months. MSCI is the leading investment research firm that provides stock indexes, portfolio risk and performance analytics to institutional investors and hedge funds.

In her presentation, Mrs. Demay showed that real estate had provided the highest total return of all main asset classes over the last 10 years at 7.4% pa, compared to equities at 6.0%. In the past 12 months, the pandemic has hit returns from most real estate sectors. All property total returns stand at -2.9% to the end of June, with industrial and offices performing best. Central London retail investments in properties was the best performing retail segment.

Costar is the world leader in real estate information, providing data and forecasts to thousands of property professionals in the UK, the US, Canada and Europe. Mr. Mark Stansfield, Head of UK Analytics, provided a comprehensive review of the central London office and retail markets and noted that vacancy rates across London office markets are rising and rents have begun to fall. CoStar’s current baseline forecast sees office rents continue to ease during 2021 but beginning to increase again from mid-2022. Mr. Stansfield also noted that whilst a number of retailers are closing stores, demand for well-located retail investments in central London remains strong.

Finally, Mr. David King, Director of Consulco Real Estate in London, highlighted the three themes that Consulco expects to out-perform average property market returns over the next five years. Mr. King identified properties in central London locations that have been hit hard by Covid-19, regeneration in London suburbs and the Oxford to Cambridge arc, as areas to target in 2021.

For more information on the webinar, the presentations and the services Consulco provides, please contact Michael Tannousis at invest@consulco.com.