Consulco has reviewed the economic forecasts for the UK and considered how these will impact the commercial real estate market.

We have identified three themes that we believe will out-perform the market; Recovery, Regeneration and Research. We publish our thoughts on Regeneration and Research shortly – this article focuses on Recovery.

During times of economic and social dislocation, existing structural trends accelerate, and new directions emerge. Real estate, one of the key foundations of all economies, is not immune to these changes – bricks and mortar that have stood for centuries have become redundant and new uses must be found.

The current situation, brought on by Covid-19, is no different. The pandemic has accelerated existing structural changes, has created short-term dislocation is some sectors that will in time recover and been the genesis for new ideas and new developments. Real estate will react to all these influences; in some sectors values will continue to decline, in others sentiment will over-react, creating opportunities to invest, while in a few locations and sectors demand will continue to increase.

During the UK lockdown that commenced on March 2020, internet shopping (particularly, but not exclusively, for groceries and food products) increased dramatically. Whilst demand for distribution warehousing and last-mile units has increased, in-store retailing has been hard hit. Fashion retailers, who have driven high street rental growth for the past 30 years are contracting. We expect rents to continue to fall, dragging down capital values and total returns, for the foreseeable future.

The impact of the pandemic on the UK tourism and hospitality industries has also been significant. With all but essential travel banned, followed by the new regime of short-notice quarantines, overseas visitors to the UK have plummeted. This has led to increased unemployment rates and reduced footfall in consequence many retail companies cannot afford rent due to reduced turnovers.

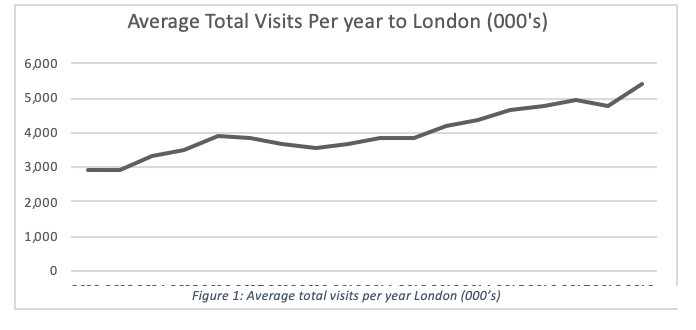

However, we forecast that international travel and tourism will recover and that cities that have enjoyed the benefits of mass travel, from Limassol to London, will see numbers begin to return. We expect tourism sector to struggle for the next 6 months before a strong rebound from Q3 2021. The graph below shows how quickly international tourism returned following the GFC and 9/11:

Official economic data showed that the UK economy has suffered its worst ever quarterly contraction in GDP in Q2 2020, with the economy shrinking 20%. This was expected given that the strict lockdown and social distancing measures disrupted economic activity and spending. Encouragingly, monthly GDP figures and business survey data point to a substantial improvement in economic activity in Q3 & Q4, as businesses reopened, workers returned to offices and travel restrictions were eased. Although the outlook remains uncertain, the UK is leading the vaccination race while approximately 50% of the population have had their first Covid-19 vaccine dose. The economy shows resilience and once all social distance measures are lifted, we expect a rebound in the UK economy.

Both commercial property market investment and occupier activity have slowed in line with the decline in economy activity as the introduction of lockdown measures in March 2020. Travel restrictions have also limited access for cross border investors, especially Asian buyers. It appears that after the lockdown, investors are returning as over £4.4 billion worth of capital was transacted in September. This increase in transaction is indicating that transaction activity should start to pick up, once lockdown and social distancing restriction are totally eased.

This loss of custom is leading to many operators struggling to meet their financial obligations, individuals and investors are holding off making significant financial investments, resulting in falling demand and in consequence, falling rental and capital values. Similar economic and real estate data was visible in the 2008 and 2009 GFC where prices have rebounded and reached all-time highs. This gives the opportunity to invest in attractive location at attractive prices in central London in the retail, restaurant and leisure sector because once the pandemic is over, property values will once again rise.

David King, Director, Consulco Real Estate

Stavros Aristodemou, Financial Analyst, Consulco