An investment choice with stable returns and security

Consulco Capital has established the London Credit Fund, licensed and regulated by the Cyprus Security and Exchange Commission. The fund and its subsidiaries provide short and medium term business loans in the UK, secured against London Real Estate. The target return for the Euro Investors, exceeds 4% p.a. and it’s payable quarterly. The London Credit Fund’s underlying loans are secured against London Real Estate, one of the most prime investment assets in the world that provide solid security and comfort to all fund’s investors.

Growth and resilience

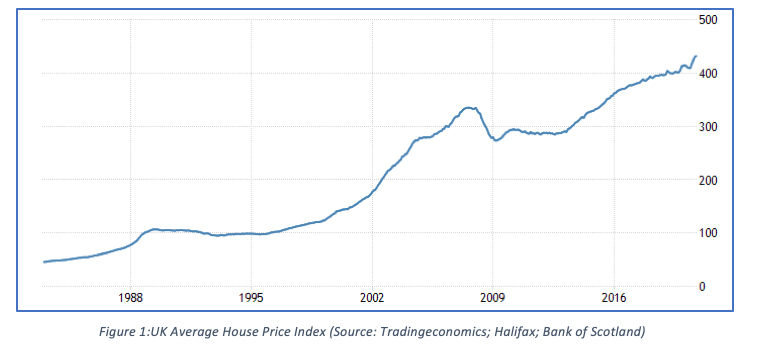

The UK’s property market has been characterised by a series of peaks and troughs over the years. Demand has consistently outstripped supply, often leading to enormous increases in house prices. In 1980 and 1990, the mortgage lending grew thanks to the ongoing deregulation of the financial sector and because of the strong confidence in the UK’s economy, it made it easier for investors to secure a loan and purchase properties, increasing real estate prices.

During the 1991 recession, interest rates increased, unemployment rose, and people struggled with the mortgage payments. This led to fall a in real estate prices. Towards the end of 1990’s prices started to rise again. Since then, prices have consistently outstripped both inflation and real wages. The supply of housing has not met the ever-increasing demand, and inevitably, a housing bubble was created. With the 2008 financial crash sending shockwaves around the world, real estate prices dropped dramatically.

Following the 2008 Global Financial Crisis, UK house price have begun to rise again, people would chase a stable cash flow with cheap debt amid low interest rates, exploit tax advantages, diversify and hedge against inflation.

Real Estate in London has a long-term value appreciation. Although real estate prices had its ups and downs, the overall trend is appreciation in value. If you can afford to hold the real estate investment during bad times when prices are low, eventually prices will rise again to a higher point. Investors want to enjoy steady income, in the form of rental income, while also outperforming inflation.

London is one of the world’s biggest financial centres, it is home to internationally recognised banks, businesses and world-famous brands, world class universities, bringing huge amounts of opportunities into the capital. London property represents 18% of the total value of the UK property and it is considered a ‘safe investment’. Despite the political events, financial crisis and even Covid-19, the London property market is not as volatile as the rest of the UK and other property markets.

London’s position as a top financial centre brings with its real state that is fit for purpose with global occupiers and strong covenants. While its exposure to financial and business services increase market volatility, its top-ranking real estate channels global capital.

Liquidity

London real estate market is highly liquid compared to other real estate markets. Even in the worst market condition there is an exit strategy. There is always a buyer for good stock. According to CBRE, from the period of 2008 to the mid-2018, the UK accounted for over 30% of the European real estate investment market, and more than a third of the cross-border component. The depth, maturity and transparency of the UK market, and associated quality of legal and business infrastructure, are among the explanatory factors – all of which are likely to persist for many decades.

London is in a league of its own here even in a European context, accounting for 12.5% of overall European investment and about 40% of the UK total. This makes London the largest urban investment market in Europe.

Transparency

Transparency also plays a major role. Independent research, data and industry scrutiny from the press, advisors and equity analyst all serve to create a very transparent and relatively easy to understand market. The Global Real Estate Transparency Index published by real estate adviser JLL and real estate investment manager LaSalle has revealed that the UK remains the world’s most transparent market for real estate. The research cited that the UK market is pushing the boundaries of transparency through technology, a focus on sustainability, anti-money laundering regulations and enhanced tracking of the alternative sectors. The Global Real Estate Transparency Index also named London in the world’s top 15 most transparent cities.

Increasing demand

There are more people living in London that ever before. According to data published by the Official for National Statistics (ONS), the population in the capital has been growing by 1.1% on average annually since 2012. This equated to 96,000 additional people each year. In contrast, the number of houses being built is rising at a slower rate in London than any other region. Research by estate agency Savills, suggests that the delivery of new homes is still falling short and that demand is outstripping supply.

London is also one of the most popular tourist destinations in the world, attracting millions of visitors per year. People travel from around the world to admire London’s impressive monuments, explore the richly vibrant culture, the architecture and theatrical performances. Revenues generated by tourism in London comprise approximately 10% of the city’s gross value-added income, and it is projected that tourist in London spend approximately £15 billion per year.

Government Intervention

The government and London boroughs continue to seek inward investments into regeneration projects, large and small, to boost their local economies and to benefit their residents. Some local authorities began to regenerate their main retail areas and central business districts 5 to 10 years ago (eg. Croydon) while others are just beginning (eg. Woolwich). There are also significant transport projects that will open in 2021 and 2022, enhancing the prospects of several locations such as the Elizabathe Line, Northen Line Extension and the Crossrail 2. In addition, the recent changes to the Use Classes Order (a government regulation that sets out how land and buildings can be used) will allow greater flexibility in suburban centres as local authorities seek to find new uses for redundant shops, shopping centres and offices.

Securing loans against London Real Estate

So, what are the benefits of securing loans against London Real Estate? Lenders usually get a first charge over the property, i.e. if the borrower defaults, the lender is entitled to the property. Our loans are secured on a first charge which reduces the risk of the investment as London residential property is highly liquid, transparent and proved to be resilient over the years.

Under UK Legislation, enforcement of the security of the property, the lender can sell the property without a court order within 3-6 months. According to Rightmove, UK’s largest real estate portal, the average time it takes to sell a property in London is 8.5 weeks or 60 days. In addition, as seen above, even if the lender decides to keep the property, prices will eventually rise as the London Real Estate Market is resilient.

According to the land registry data, the largest housing drop was 22% during the Global Financial Crisis. Even with a drop of 25% in house prices, our secure loans do not exceed 70% LTV providing a secure buffer for our credit investments.

There are many reasons investors across the globe have bought property in London over the years. It is considered a “safe haven” for investors, as the availability of job opportunities and cultural attractions means that it is very much a desirable place to live.

Considering the growth in the London property prices seen over the past ten years, demand outstripping supply, and the high liquid and transparent real estate market, securing loans on residential real estate has many advantages and benefits, reducing the overall loan to a minimal risk, even if the borrower defaults.

Marios Theophanous, Credit Manager

Stavros Aristodemou, Financial Analyst

Stavros Pantelides, Financial Analyst