As UK interest rates continue to rise, our London-based real estate experts have analysed other locations that should provide strong income returns over the next five years and protect investors from inflation.

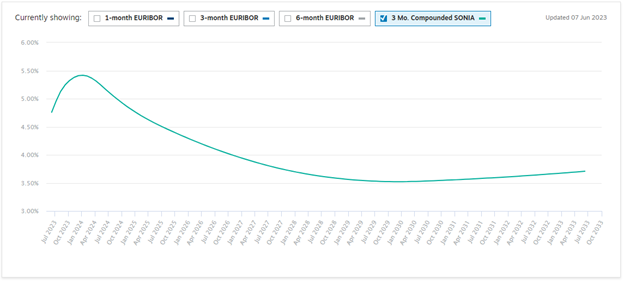

Property values are directly corelated to interest rates – as rates rise, property values fall. Since the Bank of England first raised rates in March 2022, the base rate has increased 13 times and now stands at 4.5%. Nevertheless, core inflation remains high and markets expect rates to increase to between 5.25 and 5.5% in early 2024, before stabilising and eventually falling.

With commercial property investments in London providing income returns of only 5% to 6%, we need to look beyond the M25 to the UK’s key regional cities to find value in this unprecedented market.

We highlight three cities that can provide high income returns with the possibility of capital growth over the medium term; Birmingham, Manchester and Leeds. Whilst each is different, these cities share a number of positive characteristics.

Regional Capitals

Each city is the focus for its region’s commercial, administrative, retail and cultural sectors. Birmingham encompasses the West Midlands and draws in from Wolverhampton, Coventry and Solihull. Manchester’s ‘suburbs’ include Bolton, Oldham and Stockport, whilst Leeds is the centre for towns such as Bradford, Wakefield and Castleford.

Regional Airports

Each city benefits from a major airport, providing fast connections to European capitals, the US and holiday destinations. Although still recovering from COVID restrictions, 23.4 million passengers travelled through Manchester, 9.3 million through Birmingham and 3.3 million through Leeds/Bradford in 2022.

Universities

Each city provides at least one top class university as well a number of regional and local universities. All three cities continue to improve their graduate retention figures as the lure of London fades.

HS2

With London’s new Elizabeth line fully opened, attention turns to the UK’s largest infrastructure project – High Speed 2. This new railway line will run from London to Birmingham and then on to Manchester. It is hoped that it will one day link on to Leeds, but that element is on hold for the time being. Once operational, HS2 will serve over 25 stations connecting around 30 million people. HS2 will significantly improve connectivity in the North and Midlands and will also integrate the existing network serving stations into Scotland, creating 500,000 extra jobs and 90,000 homes around HS2 stations.

Having identified these cities, it is important to understand the geographies, streetscape and occupier demand in each. In a rapidly changing world, it is easy to acquire assets that will underperform in the medium term – it is much more difficult to secure investments that will hold their value whilst delivering an attractive income return.

Let’s start with Birmingham. We need to consider the impact of the Bullring and the arrival of HS2. The Bullring shopping centre, which opened in 2003, changed the footfall pattern in Birmingham forever. The centre provides a floor area of over 147,300 square metres of retail, together with over 3,000 car parking spaces. The centre dominates the city’s retail offer, making most other retail streets secondary. The main HS2 station will be located at the eastern edge of the city, close to the National Exhibition Centre and Birmingham airport. However, a spur will bring some HS2 services into the city centre at the rebuilt Curzon Street station. Savvy investors will understand these dynamics and focus their search on locations between and around the Bullring and the new station.

Moving north to Manchester, we find a thriving city centre returning to life after COVID lockdowns. Footfall in central Manchester has reached a higher level than central London and the city is less impacted by the working from home trend. The prime retail pitch has changed little since the centre was replanned and rebuilt after the powerful IRA bomb wreaked havoc in 1996. Market Street, King Street and St Anne’s Square continue to attract retailers and food/beverage stores within the city centre. Our focus in Manchester should be on these traditional prime locations. Values have fallen dramatically – in some cases by almost 50% – and it is now possible to acquire prime retail investments at initial yields in excess of 7.5%- 8%.

The retail offer in Leeds city centre has been hit by an oversupply, with three shopping centres opening in the past 15 years. With weak demand and a large number of empty units, it is important to understand where the prime area now sits, the size of units in most demand and the value of landlords’ incentives required to tempt tenants to sign.

Time to invest.

As UK interest rates rise, investors are seeking real estate opportunities beyond London to achieve strong income returns and protect against inflation. Birmingham, Manchester, and Leeds stand out as regional cities with positive characteristics, such as being commercial, administrative, and cultural hubs. The presence of major airports, renowned universities, and the future impact of the HS2 by improving connectivity and creating jobs, adds to the investment potential further and enhances their appeal.

We want to help our clients take advantage of the dislocation in the investment market to acquire higher yielding assets in these three cities. With UK interest rates forecast to peak in January next year and to fall back below 4% by the end of 2026, it is a good time to be buying for income and with the prospect of capital appreciation to come through yield compression.