The UK Economy Market Outlook – August 2025

The UK economy has absorbed the shocks from Brexit, COVID-19, “Truss-onomics” and more recently the Labour Party have completed their first year in power in 14 years. We’ve also seen the fallout out from aggressive trade policies from an increasingly unpredictable President on the other side of the Atlantic.

There’s no doubt that the continued global political and economic uncertainty have resulted in subdued business confidence and growth. Inflation has eased but remains above the Bank of England target of 2.0%. The UK economy has shown strong resilience and is at a critical juncture with all eyes on the government and Bank of England to see how they will navigate the next 24 months.

Macroeconomic Overview

The UK economy recorded modest growth of 0.3% in Q1 2025 – this is a reflection of the subdued business confidence following the Autumn Budget and the wave of tax increases announced by the new Chancellor, perhaps most notably the increase in employers’ National Insurance contributions which are going to squeeze profit margins across the board. The CEBR is expecting total growth for the UK over the course of 2025 to be 1.1%, which is supported by high levels of government expenditure, but hindered by lower private consumption.

The 2025 Autumn Budget is expected to see the introduction of further tax increases. The government has refused to comment on which taxes will be changed, although the freezing of income tax bands is a likely option. The Prime Minister has also declined to rule out a wealth tax which could see a 2% levy on assets above £10m imposed.

In an apparent win for Sir Keir Starmer’s Labour government, the UK agreed two free trade deals with India and the US. The FTA with India has focused on the trade of textiles, footwear and agricultural products entering the UK and British made products such as whiskey, automobiles and pharmaceuticals being exported to India, with lower tariffs in both directions. This deal is expected to add £5 billion to the UK economy annually.

The UK was the first country to agree a trade deal with the US after the “Liberation Day” tariffs wreaked havoc over global equity and debt markets. Whilst both governments have been careful not to announce all details of the deal, it does, however, provide some much needed certainty around UK trading conditions with the world’s largest economy.

Inflation and Monetary Policy

In its May 2025 meeting, the Bank of England’s Monetary Policy Committee (MPC) voted 5–4 to reduce the Base Rate from 4.5% to 4.25%. This decision reflects concerns over weakening domestic demand and global trade uncertainties. Some MPC members advocated for a more substantial cut to 4.0%, citing the “perilous” trade environment and potential risks of delayed policy responses. However, this approach is countered by inflation which is still above target. (Source: Bank of England, 2025).

The next MPC meeting is in August with most economists and traders expecting another rate cut of 0.25% taking the base rate to 4.0%.

The Bank forecasts inflation to rise to 3.5% by Q3 2025 before gradually declining, though it is expected to remain above the 2.0% target until early 2027. This persistent inflationary pressure limits the central bank’s ability to implement aggressive rate cuts without exacerbating price stability concerns.

Labour Market and Employment

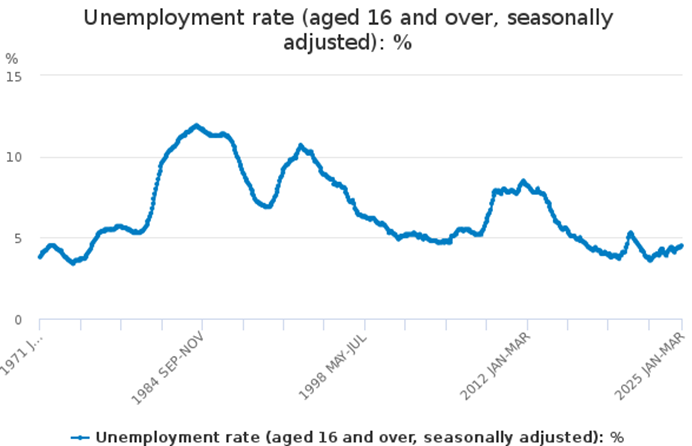

The UK labour market is exhibiting signs of strain. The latest data from the Office for National Statistics (ONS), the employment rate for individuals aged 16–64 stood at 75.1% between December 2024 and February 2025, with unemployment rising to 4.5%, marking an increase of approximately 110,000 unemployed individuals over the year. (Source: House of Commons Library, 2025 and Office for National Statistics, 2025).

Employer confidence has declined sharply, influenced by increased National Insurance contributions, a higher national living wage, and uncertainties surrounding the forthcoming Employment Rights Bill. The Chartered Institute of Personnel and Development (CIPD) reports that nearly a quarter of employers anticipate redundancies in the coming months, with significant impacts on the retail, education, and healthcare sectors.

Additionally, surveys by KPMG and the Recruitment and Employment Confederation indicate a decrease in demand for both permanent and temporary staff, reflecting broader labour market challenges. (Sources: The Times, The Guardian, The Financial Times, 2025).

Business Sentiment

Business sentiment in the UK has deteriorated. The Lloyds Bank Business Barometer reported a 10-point decline in confidence in April 2025, bringing it to 39%, though it remains higher than at the start of the year. The Institute of Chartered Accountants in England and Wales (ICAEW) noted that confidence is at its lowest since late 2022, with 56% of companies citing taxes as a significant challenge.

The Chartered Institute of Personnel and Development’s (CIPD) sentiment tracker fell from +13 to +8 in the last quarter, indicating a sharp drop in hiring intentions. This decline is attributed to increased labour costs and regulatory burdens introduced by the Labour government. Furthermore, a survey of more than 2,000 companies conducted by the CIPD showed that 24% of companies are planning on making redundancies in the next 3 months.

These factors have led to a cautious investment climate, with businesses delaying expansion plans and reducing workforce investments.

The short term volatility in the UK and across the world has led to some negative press for Britain as a place to do business. However, looking at the long term, the UK is attracting significant foreign investment across multiple sectors. Amazon Web Services has announced an £8 billion investment to build and operate data centres in the UK as an expansion of its existing presence here to meet the growing demand for cloud services.

US private equity giant, Blackstone, is spending up to £10 billion in what will be Europe’s largest data centre on the former Britishvolt site in Northern England. This is expected to create 1,200 long term construction jobs.

London is at the forefront of the global FinTech sector – Revolut, the British multinational neobank has just secured a valuation of $45 billion. Monzo, the online bank is currently valued at £7 billion. Both companies are rumoured to be looking at IPOs within 12 months with London considered as an option for the listings.

The US-based parent company of Universal Studios has announced plans to develop a new theme park in the UK which is expected to generate nearly £50 billion for the UK economy by 2055 and create approximately 28,000 new jobs.

Meanwhile, the CEO of BlackRock, the world’s largest investor with c. $11.5 trillion of assets under management has confirmed they are investing billions into the UK across multiple sectors as they see long term value in the UK economy.

Public Finances and the UK Fiscal Position

The Office for Budget Responsibility’s (OBR) March 2025 Economic and Fiscal Outlook projects public sector net borrowing to decrease from £137.3 billion (4.8% of GDP) in the current year to £74.0 billion (2.1% of GDP) by 2029–30. As we have seen in recent weeks and months, these projections can vary widely and are subject to political and economic events all over the world.

The Chancellor, Rachel Reeves, stated in her Autumn Budget that the government would not borrow to fund day-to-day operations, although the fiscal headroom she has to work with is deteriorating, in part due to the government’s spectacular U-turn on welfare payments. Speculation that the Chancellor will have no choice but to introduce a fresh round of tax increases in this year’s budget is already rife.

Any further tax increases would be badly received across the political spectrum and the business community. So, the Chancellor is in the unenviable position of potentially having to break her “iron clad” budget promise to not increase borrowing, or increase taxes.

Economic Outlook

Growth – The UK economy is expected to stay on its modest growth trajectory over the next two years, with growth of 1.0% expected in 2025 and 1.9% in 2026.

Inflation – Inflation has reduced significantly over the last 24 months although is not expected to return to the Bank’s target level of 2.0% until 2027. Inflation has remained stubbornly high due to continued strong wage growth and high energy costs. The global trade wars have also impacted on this although this is considered to be a shorter term issue.

Unemployment – The increased costs of running a business, in part caused by National Insurance and business rates increases, have resulted in employers reducing or scrapping new hiring altogether, and in some cases making redundancies. This trend is expected to continue until more stability is established across the UK and global economies.

Interest rates – The market is now pricing in one, or possibly two, further interest rate cuts this year. The minutes from the latest MPC meeting would suggest that one further cut of 25bps is more likely. The slower rate of reductions is due to higher-than-target inflation levels. The higher interest rates have a knock-on effect on the property market and wider economy, which will have an impact on growth forecasts.

Business investment – Investment levels are likely to remain subdued amid regulatory uncertainties and global trade challenges.

Conclusion

The UK, and London in particular, have received some bad press over the last 12 months – whilst it can be argued that some of this is justified, the fact remains that London is, and will continue to be a global financial hub.

As written above, the government and Bank of England have a critical role in boosting the economy through policy, taxation, and interest rates. Looking through the short term volatility, the long term prospects for the country remain attractive to UK residents and foreign investors.

Rob Hammond, Head of UK Real Estate, Consulco

The UK Economy Market Outlook – August 2025