Assessing the effects of Brexit in context of the current state of global affairs and the ongoing pandemic is clearly very difficult, given it is hard to distinguish which effects are related to Covid, economics or politics.

However, reports indicate that the UK is and will remain a leading destination for global capital. Post-Brexit, Britain has become the fourth most favoured investment destination globally, with investment in commercial property reaching £25.7bn in H1 2021, up 15% from H1 2020. Furthermore, the long-term picture remains balanced, as a result of strong government policies and investor confidence in the UK market.

Impact of Brexit on UK Real Estate

The UK is already a favoured destination for real estate capital and global leader in Real Estate investment. According to a PwC survey of 5,000 companies from March 2021, Post-Brexit Britain has become the fourth most favoured investment destination globally, overtaking India in the process.

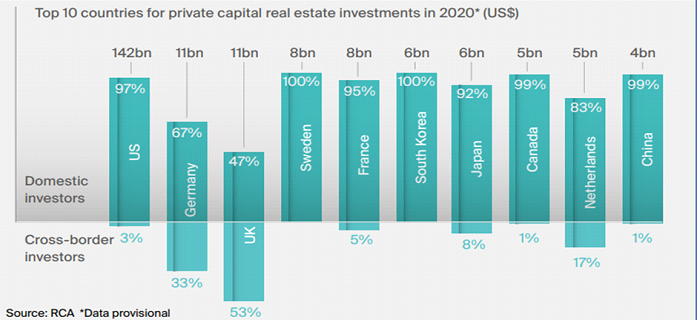

In terms of the Real Estate market, Real Capital Analytics data clearly highlights an even split of foreign to domestic capital invested in the UK, emphasizing the diversified strength for real estate investment in the country. Figure 1 below shows that out of $11bn invested in the UK real estate market in 2020, 47% were domestic investors and 53% were foreign, demonstrating the confidence of foreign investors in the UK real estate industry in the midst of the Covid Pandemic and looming Brexit date.

Trust in the UK real estate industry is also supported by statistics from the first half of 2021. Investment in commercial property reached £25.7bn in H1 2021, up 15% from H1 2020 and 10% from 2019 (Savills,2021), outperforming the expectations of many economic analysts. In addition, the momentum built up from H1 2021 is likely to result in exceeding 2020’s £50bn total investment volume.

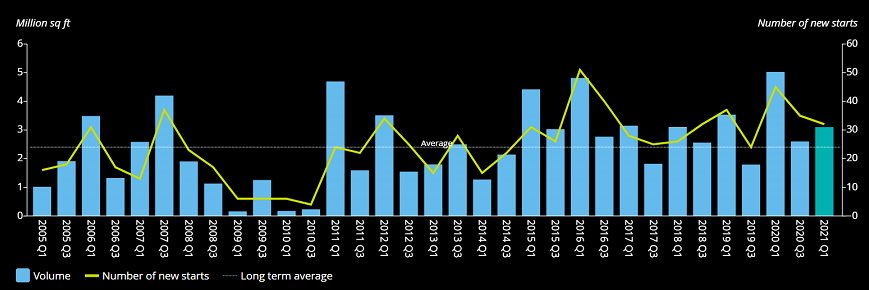

Looking at the UK capital specifically, figure 2 below shows the number of new office developments and refurbishments occurring in London on a quarterly basis. New office starts in London reached 3.1mn square feet in Q1 2021 according to Deloitte’s London Office Crane survey, suggesting that the higher proportion of speculative development demonstrates confidence by investors and developers in the city’s ability to absorb the excess supply of new office space.

In other sectors, Savills’ latest commercial report (Sep 2021) shows London Hotels experienced yield compression from 4% to 3.5% and London high street retail maintained a stable yield of 6.75%, suggesting a strengthening of the subsectors more sensitive to Brexit and the restriction of movement of both workers and tourists. The expectation is that good government policy will reinforce the resilience shown the more vulnerable sectors over the mid to long term.

Furthermore, fear that the UK may lose access to the EU Capital Market Union remains an unlikely scenario, particularly given the UK’s importance to Capital Markets in Europe overall, as emphasized previously. Real estate capital moving into the UK is likely to remain unaffected in the short to medium term and likely to remain a very strong and open destination for real estate capital (CBRE,2021).

Summary

Longer-term, the picture is balanced and positive. Initial disruptions caused by Brexit are expected to fade, particularly regarding freedom of movement and foreign direct investment. The statistics highlight a bullish case for the UK Real Estate market and investment environment overall, indicated by increased overall investment volumes, the resilience of vulnerable sectors and the UK’s status as a global investment hotspot.