Executive Summary

Although 2022 started positively with a growing economy with rising Real Estate prices and strengthening of the labour market, geopolitical tensions took over. The Russian and Ukraine war has pushed up energy and commodity prices, adding inflationary pressures to the UK and all around the world forcing central banks to increase interest rates.

As a result of increasing interest rates, the cost of debt is increase, hence more investors are forced to buy Real Estate through equity, which makes it more challenging for property investments and pricing and expecting a lower investment volume in 2023.

Based on CBRE, the challenge for property and lower investment volumes should be a short lived and moderate recession, with recovery evident towards the end of 2023. “Real Estate investment markets will emerge from a period of uncertainty, pricing should stabilize, and activity should return.

Economic Outlook, Interest Rates and Inflation

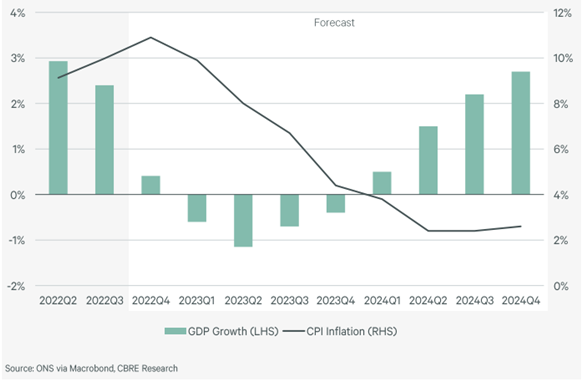

After a very strong post-Covid rebound, the UK economy will face a slowdown in 2023. Output has started to decline, and inflation is peaking. CBRE also expects a moderate slow down in 2023, with GDP falling by 0.9%. In 2024, the economy will recover, growing by 1.7%.

The key economic challenge has been inflation, which has been at double digits for most of the second half of 2022, and hitting levels not seen since the 1980s. To contain inflation bank of England has increased interest rates.

CBRE also expects inflation to peak at the start of 2023, and then slowly reduce. This reflects a reconfiguration of supply chains, falls in commodity prices and the rise in interest rates.

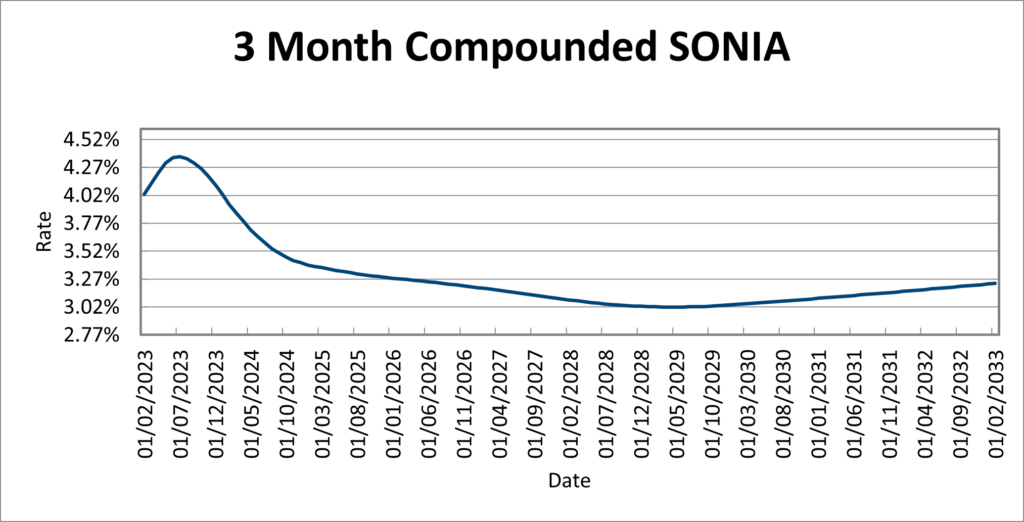

Interest rates are approaching their peak. The BoE has reacted to the steep rise in inflation by tightening interest rates. The Bank is likely to tighten further, reaching a peak of 4.5%.

The 3M SONIA forward curve indicates that interest rates are expected to rise and peak in 2023 at around 4.50%. This so inflation can be contained and reduced to the BoE’s target of 2%. Following the peak, interest rates are set to fall, gradually which is also in line with the inflation projections.

What does higher interest and inflation mean for Real Estate?

Commercial Real Estate

The ongoing yield shift has hit values and returns for past investors. As the cost of capital, closely related to the interest rate of central banks and therefore to inflation have risen, hence valuations have changed.

However, if according to CBRE and the Sonia forward curve about interest rates and inflation peaking in 2023, then we see the possibility of yield compression and capital appreciation by late 2023 early 2024. This depends on how quickly yields correct after inflation and interest fall, as well as on when the interest rate loosening begins.

Income returns, rather than capital growth, is likely to drive commercial real estate returns in the year ahead. This means more focus on asset management, and on the financial performance of occupiers, as key factors that affect income and occupancy at the asset level.

Residential Real Estate

A survey carried out by Savills in December showed that buyer commitment had improved since it last survey in August which forecasts that the most active buyer groups are needs based buyers in early 2023, with equity-rich buyers return as the year goes on.

Frances McDonald, Savills residential research analyst mentioned “A return to a more stable political and financial environment following the tumultuous ‘mini-budget’ has led to a more positive outlook among potential buyers and sellers, despite the expectation of further economic uncertainty.

While there are very clear headwinds, this survey suggests that there is a strong seam of demand in the market, but that it will be clearly split between those who need to move quickly and more discretionary buyers equally committed to moving.

Correlation of real estate and inflation:

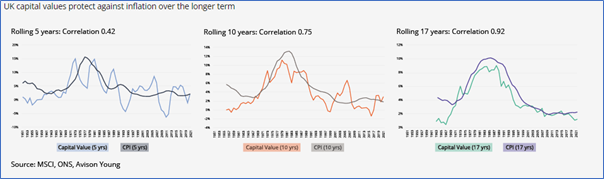

Analysis conducted by Avisonyoung suggest that real estate is an inflation hedge but mostly over the long term. This was examined by looking at the relationship between inflation and property values over different “hold periods”.

The findings show that UK capital values protect against inflation and this relationship improves over longer time horizons – the optimum hold period in the UK is 17 years.

In comparison, UK all-share equity market correlations with inflation over the equivalent periods are significantly lower, with coefficients of 0.20, 0.36 and 0.59 respectively.

Conclusion

Not just the UK, but the whole world is facing inflation pressures, mostly due to the Ukraine war and Covid-19. Central banks around the world are forced to increase interest rates hence affecting real estate investments and pricing.

Many investments around the world are also seeing a decline, specially stocks, equities and cryptocurrencies, which saw the largest decline in 2022. Real Estate has held well in 2022, with a small capital increase in 2022.

As seen above, inflation is starting to slow down, interest rates are set to peak, so you should expect many opportunities in 2023 to invest in London Real Estate.

Stavros Aristodemou, Senior Investment Analyst, Consulco