Executive Summary

The start of 2023 has been challenging for investors around the world. High inflation and high interest rates are putting pressure on growth and costs. As a result, the real estate market and all asset classes in general are facing a challenging environment. Nevertheless, the UK Real Estate market has proven to be resilient through the years and will provide opportunities for new investors once the market stabilizes from inflation and higher interest rates.

For the first half of 2023, output has started to decline; inflation remains high and the labor market shows signs of weakening. For 2023, a moderate recession is expected, with GDP falling by 0.9% while expecting a 0.3% growth in the last two quarters of 2023. (ONS,2023)

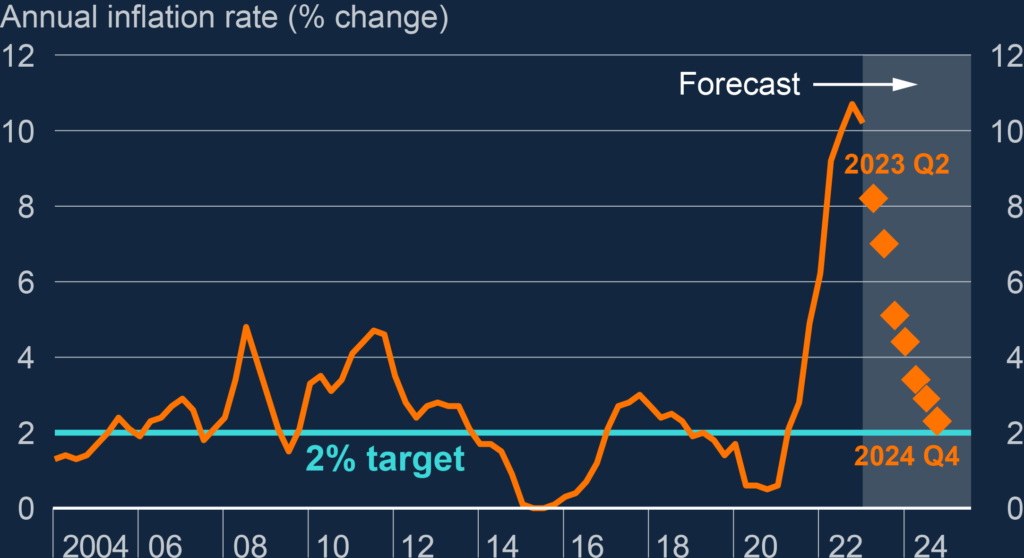

Inflation in Britain reached its highest levels in decades, driven by soaring food and fuel prices, which were additionally influenced by Russia’s war in Ukraine. The UK Government and the Bank of England are taking measures to reduce inflation such as increasing interest rates and using the Energy Bill support Scheme.

In 2023, investors expect another interest rate hike, aiming for a 6% base rate by year-end (Guardian, 2023). The UK property market, less leveraged than during the global financial crisis, remains strong due to diverse lenders. However, with rising borrowing costs and declining asset values, refinancing has presented challenges among investors (CBRE report).

The UK housing market has experienced a decline in activity during the first half of 2023. This slowdown has been influenced by several factors, including the cost of living challenges, reduced real incomes, and notably, the implementation of tighter monetary policies through increased interest rates. However, residential prices proved to be resilient for both buyers and renters due to restricted housing supply caused by planning limitations and a shortage of new properties.

In summary, the start of 2023 has brought challenges for investors worldwide due to high inflation and interest rates, impacting the real estate market and other assets. The UK economy is likely to emerge from recession. This is due to an improved energy price outlook, a more resilient global environment and continued tightness in the labor market (KPMG, 2023). The UK real estate market’s resilience also offers prospects for new investors, despite the current challenging environment.

Economic Outlook, Interest Rates and Inflation

UK Gross Domestic Product (GDP) shrank by 0.1% in May 2023, with the UK economy expanding slightly from February 2020, just before the COVID-19 lockdown began. Low business investment, weak productivity growth and a very tight labor market are also symptoms of economy struggling to adapt to a post-pandemic and post-Brexit future (Statista, 2023). This has also been enhanced by rising interest rates and high inflation.

Annual inflation in the UK is expected to be 6.1% by the end of 2023, down from 9.1% in 2022. The main causes of today’s inflation are mostly due to the Russian war which led to a big rise in prices of gas and food. This in hand, puts pressure to businesses by charging more for their products because of the higher costs they face.

Financial markets expect the bank to raise key rates above 6% before Christmas. JPMorgan said its main forecast was for rates to peak at a low 5.75% by the end of 2023 but warned that rates could rise to 7% under “some scenarios”. Higher interest rates will help reduce demand for goods, hence slow the rate of inflation.

CBRE’s analysis indicates that investments made with leverage towards the end of 2024 could generate around 13% returns over the following five years. The potential for such returns is driven by the decline in interest rates and debt, leading to lower property yields and higher market values (CBRE, 2023).

The 3M SONIA forward curve indicates that interest rates are expected to rise and peak in 2023 at around 4.50%. This so inflation can be contained and reduced to the BoE’s target of 2%. Following the peak, interest rates are set to fall, gradually which is also in line with the inflation projections.

Real Estate

In 2023, real estate in the UK experiences significant impacts on interest rates and inflation, influencing borrowing costs for property purchases. Inflationary pressures affect property prices, impacting affordability and investment decisions. Yields on real estate investments fluctuate as investors adapt to changing market conditions. The rental market sees shifts in demand and pricing dynamics, driven by economic trends and housing preferences in the post-pandemic era.

Although volumes are expected to decline further in 2023, the UK benefits from a diverse and international investor base. Constraints that affect some investors represent opportunities for others, and private capital awaiting deployment could be one of the beneficiaries.

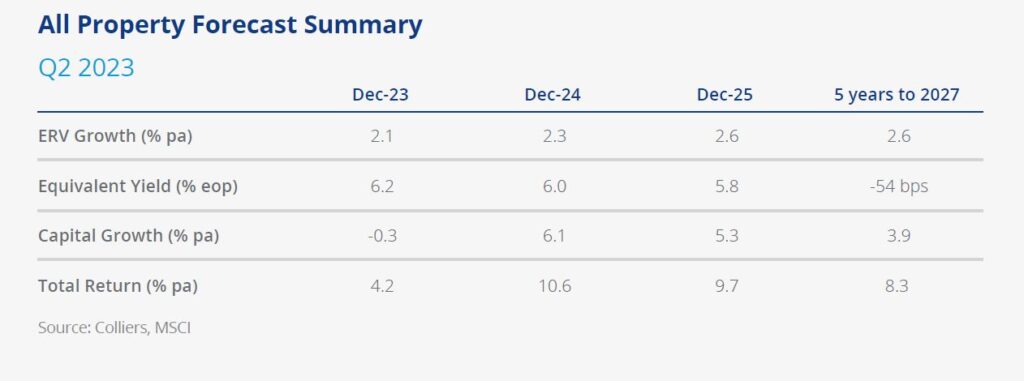

The provided data represents financial projections for all real estate. The Expected Rental Value (ERV) is projected to grow from year to year and at steady rate of 2.6% per annum over the 5-year period.

The equivalent yield declined gradually from year to year and over the five-year period leading to 2027, it decreased by 54 bps. Capital Growth shows a slight decline in 2023, but then increases significantly. Over the 5-year period, Capital Growth is projected to be 3.9% per annum. Total Return, which combines rental income and capital growth increased significantly from year to year with the 5-year projection indicating a Total Return of 8.3% per annum.

In summary, the chart shows that the Real Estate Market will bottom in 2023. This trend suggests potential stabilization or a potential turnaround, prompting investors to keep a close eye on the market for potential opportunities due to potential capital appreciation and increase in rental income.

Following a period of uncertainty, the property investment market is expected to recover, with prices becoming steadier and activity picking up again. (CBRE, 2023).

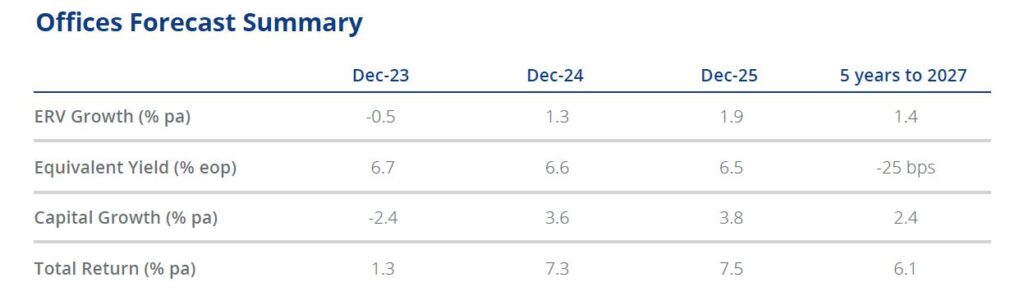

UK Commercial – Offices

Forecasts indicate a 20% decline in investment volumes during 2023, amounting to £16.2 billion, with a significant portion of £10.5 billion in the central London market. The first half of 2023 is likely to experience more limited volumes, while a recovery is anticipated in the latter half of the year.

The office rental market’s development will be limited by the decrease in office employment, the new work from home trend and the economic recession. It is anticipated that the utilization of office space in the UK will be less in 2023 than in 2022.

Overall, a growing flight to quality and reduced availability of prime space could lead to further rental pressure across the regions for Grade A offices.

Clare Bailey the Director of Commercial Research at Savills said, “with resilient Grade A demand and limited supply, this is likely to put further upward rental pressure in all of the Big 6 regional office markets over the next five years” (Savills, 2023).

Hence, the trend towards favoring high-quality properties is anticipated to persist, and real estate that fails to align with the environmental objectives of investors and occupants will face growing marginalization.

Due to the existing high demand for prime A office space, the availability levels suggest that the supply will probably continue to be limited in the upcoming years suggesting new trends and investment opportunities in the office market.

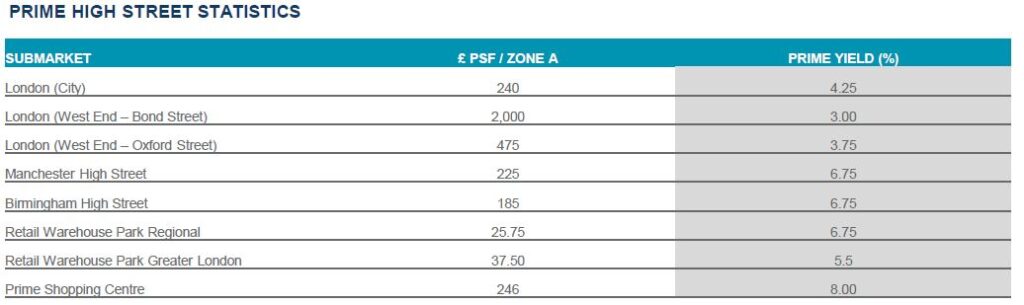

UK Retail

Since the pandemic, online penetrations have declined faster than expected, indicating that consumers still value physical retail. The metric appears to have reached a new standard for the time being.

UK retail earnings in 2023 are relatively high compared to other sectors. As a result, retail will be better protected from current debt costs and the impact of yield volatility will be less significant than other sectors (CBRE, 2023).

In the investment market, sentiment for the retail sector and related investment types remains positive, improving significantly in the first half of 2023.

According to RCA, the sector’s total trading volume reached £1.4 billion in the second quarter of 2023, well below the £3.5 billion recorded in the first quarter. However, this is well above the £955m recorded in the fourth quarter of 2022, which has been shaded by uncertainty from the economic slowdown since September (Cushman & Wakefield, 2023).

In prime locations, leading retailers like JD Sports, Zara, and Flannels are capitalizing on reduced rental costs and pursuing expansion by moving into larger retail spaces. This shift is expected to have a substantial impact on the local retail landscape and will drive increased demand for standard retail units, particularly in areas where post-COVID rent adjustments have already encouraged slight rental increases. This growth is anticipated to become evident again in the second half of 2023.

UK Residential

The residential market has shown greater resilience than initially anticipated. According to the recent RICS survey, the market conditions remain difficult, with agents foreseeing price declines soon due to increased borrowing expenses and uncertain market sentiment. Nevertheless, the outlook for the next 12 months remains optimistic (JLL, 2023).

Tighter mortgage regulations introduced in the aftermath of the global financial crisis should give the property market some protection from a high interest rate environment by requiring borrowers to “stress tested” at interest rates of around 7% (CBRE, 2023).

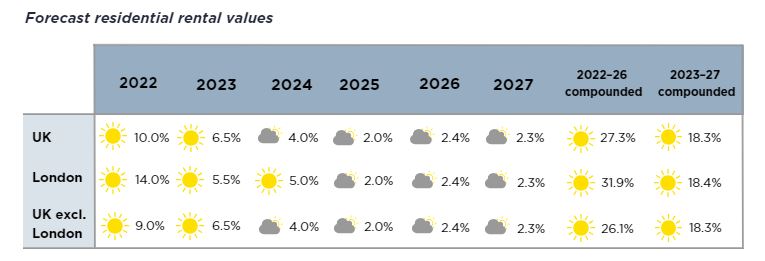

The outlook for UK residential rental values from 2023 to 2027 appears promising, with expected growth. Although the real estate market is influenced by various factors and uncertainties, experts and analysts expect a steady increase in residential rental values during this time.

The forecast is based on factors such as population growth, housing demand, economic conditions, and government policies. These factors, along with the recovery from the post-COVID crisis and the overall supply shortage within the market, are expected to contribute to the growth of residential property rental and capital values.

Conclusion

In conclusion, the UK economy is currently facing challenges following a strong recovery from the post-COVID crisis. With declining output, high inflation, and signs of weakening in the labor market, it is anticipated that a moderate recession will occur in 2023.

However, there is optimism for the future as the economy is expected to recover and grow by 1.7% in 2024. Growth will depend on inflation easing, and hence the decrease in the Bank of England base rate which will lower debt costs and increase investment volumes.

Real Estate values are expected to grow once interest rates and inflation are eased, allowing for yield compression and rental growth. The UK has proven to be resilient through previous recessions such as the Global Financial Crisis, these projections highlight the need for proactive measures to address the current challenges and support economic growth in the coming years.

Stavros Aristodemou, Senior Investment Analyst, Consulco

Marios Appios, Real Estate Analyst, Consulco