Executive Summary

- Fall in GDP lower than expected in Q1 2021 while lockdowns measures were at their most stringent levels – showing robust adaptation to economic constraints

- Unemployment remains low at 4.7% and redundancies back to pre-pandemic levels. Expected to average 5% in 2021 and 4.5% in 2022

- CPI inflation rose 2.5% in June although manageable in the context of ultra-low prices seen during the pandemic

- UK trade adapting to new trading regime showing noticeable increases in trade with non-EU nations

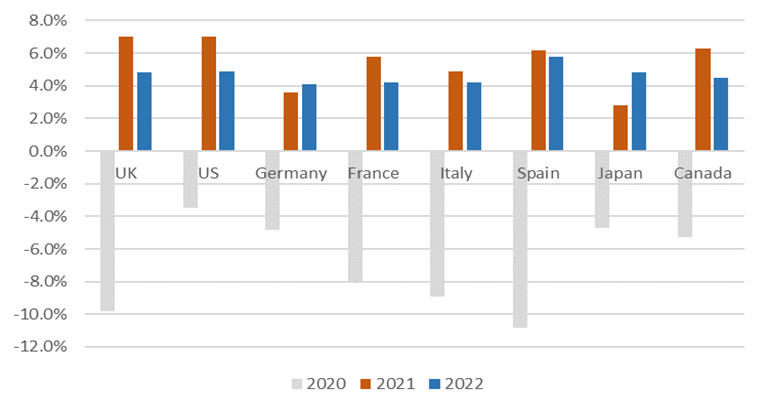

- UK GDP expected to grow 7% in 2021, 4.8% in 2022 – highest among European countries and developed economies

- Retail spending up 24% in June 2021 vs the same month in 2019, fueled by excess household savings

- UK to return to pre-pandemic levels by 2022 as a result of increased overall spending from consumers, businesses and government, supported by low cost of capital

The UK Economy: A snapshot

GDP

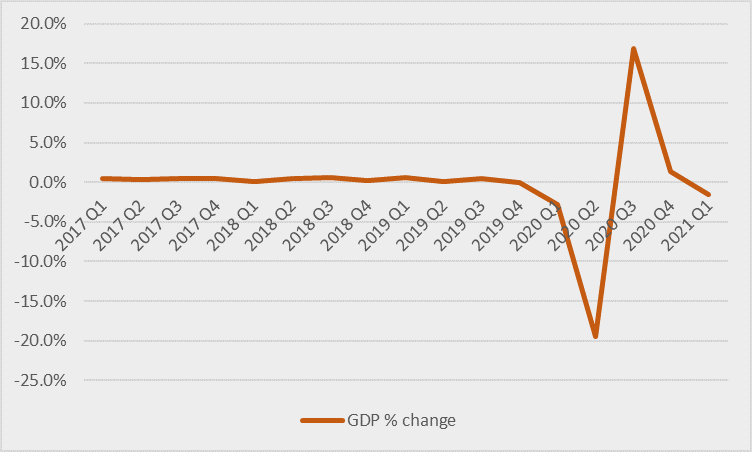

The fall in GDP was lower than expected in the first quarter of the year. Given the lockdowns were at their most strict, the UK is showing a robust adaptation of the economy to ongoing constraints. The UK economy experienced a 1.6% contraction in the first quarter according to the Office of National Statistics, mostly due to the constraint on spending.

According to the Oxford Stringency Index, the lockdowns measures from January to March were at their most stringent to date, exceeding those imposed in the first half of 2020, yet the hit to GDP was approximately 15% less.

The chart above using the latest ONS data shows that most of the GDP lost in 2020 has now been recovered. Estimations from PwC indicate that the UK economy is likely to grow by 2.3% in April – the fastest monthly growth rate since July 2020 (PwC, July 2021).

Unemployment, Inflation and Trade

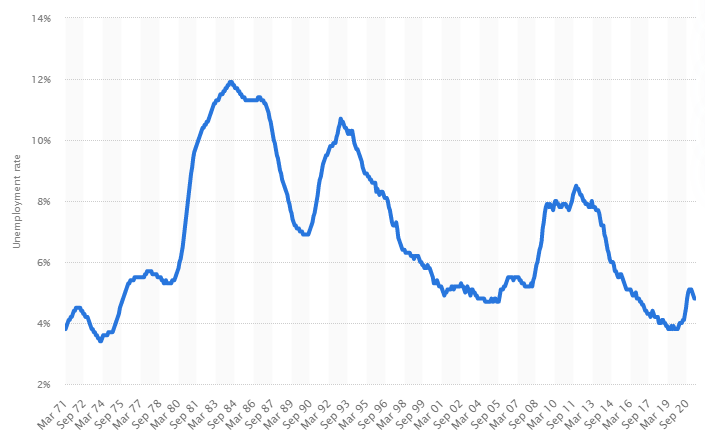

UK unemployment rate fell to 4.7% in April 2021, 0.3% lower quarter-on-quarter (ONS, July 2021) and redundancy levels have returned to pre-pandemic level, although a fair amount of employment is artificially propped up due to government support. The inactivity rate is also 0.8% higher than pre-pandemic, meaning more people are opting out of productive work which is also contributing towards improved employment figures.

The ONS indicated that the Consumer Prices Index (CPI) rose by 2.5% in the 12 months to June 2021, up from 2.1% to May; on a monthly basis, CPI rose by 0.5% in June 2021, compared with a rise of 0.1% in June 2020. Despite the seemingly large increases, we can interpret the latest price rises in the context of ultra-low prices seen during the pandemic. CPIH inflation, which includes housing costs, rose by 2.4% in June 2021 year on year, an increase of 0.3% from May 2021. The largest upward contribution to CPIH 12-month inflation rate came from transport at 0.8% (ONS, July 2021).

Statistics from the first half of 2021 indicates that businesses in the UK are adapting to a new regime post-Brexit showing noticeable increases in trade with nations outside the EU. Total UK trade with EU countries was 27% lower in the first four months of this year compared to the same period in 2019 (PwC, July 2021). In comparison, trade with non-EU countries experienced a 13% drop, meaning total imports and exports with EU countries has lagged non-EU countries, reversing pre-pandemic and pre-Brexit trends (PwC, July 2021).

The UK Economy: Outlook

GDP

UK GDP is expected to continue upwards throughout the rest of 2021 driven by four main factors:

- Increased consumers and household spending

- Continued government spending

- Increased business investment

- Low cost of capital

Consumers form the most significant part of GDP and with accumulated savings, the expectation is that retail spending will drive UK output. For example, retail spending also increased 24% in June 2021 vs the same month in 2019, which was pre-pandemic (PwC, July 2021). Government spending is also likely to continue as the treasury recently signaled its intention to maintain its levelling agenda in order to assist areas experiencing less growth. Additionally, continued reopening of the economy will likely boost confidence and a recovery in demand and sales, incentivising businesses to spend and invest.

The IMF’s outlook for UK GDP is 7% in 2021 and 4.8% in 2022, outperforming the outlook for most advanced economies.

Unemployment, Inflation and Trade

Unemployment is expected to average around 5% in 2021. Winding down of the furlough scheme and an increase in labour market participation as the economy reopens will likely underpin the slight increase in unemployment, with a reversion towards 4.5% unemployment in 2022. For reference, the 10-year unemployment rate is 5.8%.

Inflation is expected to reach about 2.8% by Q4 2021, gradually reverting towards the BoE target of 2.1% in 2022. As the economy reopens, the most sensical scenario is that inflation trends upwards due to demand-pull pressures – increase in retail and business spending, as well as supply chain shortages creating scarcity and increased costs which are then pushed on to consumer prices. Moreover, recovery in energy markets, notably oil, is likely to increase prices on household energy costs and energy intensive industries.

Trade is also expected to pick up towards the end of 2021 and beyond, as the UK crystallises more deals with non-EU trading partners and businesses adapt to the current difficulties in terms of trade clarity and increased costs. Significant structural shifts are expected in the near term although conclusions regarding the impact of Brexit are difficult to make, particularly in the context of other variables such as Covid and global supply chain issues (PwC, July 2021)

Summary

Having shown tremendous resilience throughout the first half of 2021 in the face of ultra-strict lockdowns, the UK is now showing positive signs of recovery and growth. In the first half of 2021, businesses and consumers successfully navigated the murky waters of Covid and Brexit evident by the overall impact on GDP. Other important economic metrics like unemployment levels , inflation and trade also showed positive signs, as unemployment remained low, inflation followed a natural path in the context of much lower prices from last year, and trade showed gradual improvement in comparison to 2020, as well as a movement away from the EU as firms adapt to new trading regimes.

Looking forward, the expectation is that the UK returns to pre-pandemic levels by 2022 as a result of increased overall spending from consumers, businesses and government, supported by low cost of capital and government support.