The UK Real Estate Outlook – July 2025

Following a 0.25% rate reduction to 4.25% in the May MPC meeting, markets are expecting a further reduction to 4.0% at the August meeting.

The lower cost of debt has been welcomed by homeowners and commercial landlord’s alike and transaction levels across all major sectors have ticked up over the last 3 months.

There are, however, still some wider economic headwinds hindering strong price growth that we have come to expect in UK real estate, but there remains real opportunity to buy at attractive price points.

UK Real Estate Outlook July 2025 – Residential

Residential

The UK housing market has outperformed all mainstream forecasts since 2023. The Office for Budget Responsibility (OBR) predicted that house prices would decline by nearly 5% in 2024. We can now see that the average prices actually increased by 1.7% in that time. With hindsight, the OBR had overestimated the negative impact of higher interest rates and underestimated the strength of wage growth, which measured 6.0% in 2024 and the low unemployment levels of 4.4%.

We have now seen mortgage rates reduced by 0.25% to 4.25% which will increase mortgage affordability and is expected to bring a more activity to the market.

Forecast for 2025–2027

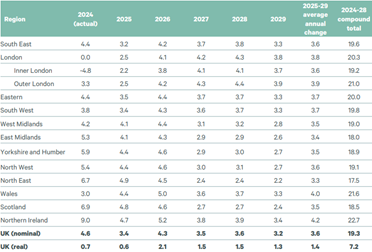

Savills are forecasting house price growth across the UK of 3.5% in 2025. This compares to 3.4% projected by CBRE. Looking at a regional breakdown, CBRE expect the highest growth in the North East at 4.9% for 2025 with inner London with the weakest growth for 2025 at 2.2%.

The table below shows CBRE’s actual growth figures for 2024 and the annual forecasts up to 2029.

Whilst inflation is significantly lower than it was in 2023/24, it has not reduced as quickly as expected and is not forecast to return to the Bank’s 2.0% target until 2027.

Mortgage Rates and Affordability

Halifax reports that mortgage rates have decreased from their 2023 peaks, with some deals now available below 4%. This easing of rates has improved affordability for many buyers. However, affordability remains a concern, particularly in London and the South East, where high property prices continue to pose challenges for prospective buyers.

Regional Disparities

The North of England is expected to lead in house price growth over the next five years, with the North West projected to see a 29.4% increase. In contrast, London is anticipated to experience a 17.1% rise according to Savills, reflecting ongoing affordability constraints and shifts in buyer preferences. Changes to the Non-Dom rules have also seen prices in PCL soften. (Source: Savills, 2025)

UK Real Estate Outlook July 2025 – Commercial

Commercial Property Market

Retail

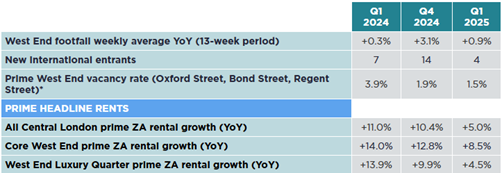

The Central London retail market appears to have a turned a corner following the low points in the market during the pandemic. Vacancy rates in prime West End locations fell to 2.2% by Q4 2024 marking the tenth consecutive quarter of decline. Rents have also increased across Central London having increased 10.4% year-on-year in Q4 2024. (Source: Savills, 2025)

Investor appetite for retail property is expected to continue to grow throughout 2025, particularly as interest rates reduce.

Office

The UK office market is experiencing a gradual recovery, with leasing levels projected to rise by 5–10% in 2025. This growth is supported by high levels of employment, as well as an increasing sentiment of “return to office”, particularly in bigger corporations. (Source: CBRE, 2025)

In Central London, the office leasing market performed well against an uncertain economic backdrop in 2024, achieving an overall take-up of 9.68 million sq ft, a 1% increase on 2023. Grade A office demand drove record rent growth in prime locations, with rents rising by 7.8% in the year to Q4 2024.

Some of the key shifts in office market performance since the pandemic has been driven by the end user experience, quality and location. As above, an increasing number of employers are encouraging (and in some cases forcing) employees back to the office. However, to do this, they need to offer well-located, high quality offices with functional working spaces and extensive end of journey facilities.

Cushman & Wakefield report that Grade A take up volumes comprised 65% of total leasing activity in 2024, surpassing the 10 year average by 4%. This heightened demand, along with the high standards or new developments has led to some of the strongest rental growth on record with rents up 7.8% in the year to Q4 2024.

The supply of new office has been restrained by the slow planning process and high construction costs – this has added further upward pressure to rents.

Agents are expecting this trend to continue throughout 2025 and into 2026.

Conclusion

As a whole, the UK property market is poised for moderate growth over the next two years, with regional disparities and sector-specific challenges shaping the landscape. Investor confidence appears to be on the up, but capital is still wary of widespread economic uncertainty.

We expect investment levels to continue to rise from both tenants and investors over for the remainder of 2025 and into 2026 – location and high user expectations will continue to dictate market trends.

The supply of new homes and commercial buildings have been restricted by high construction costs and viability issues. Interest rates are expected to continue to decrease over the next 12 months which will help increase development activity, whilst also supporting demand and improving affordability.

Rob Hammond, Head of UK Real Estate, Consulco