- UK economy resilient following Brexit transition and management of the Covid pandemic

- Economic growth projections revised upwards by the IMF, estimating 7% growth in 2021, 4.8% in 2022

- UK all-property capital values and income returns improved in the first half of 2021

- Central London office market shows increased take-up of 54% in Q2 2021, investment volumes grow 40% compared to H1 2020

- Central London retail market demonstrating increased demand for strong retail locations

- Residential markets experiencing strongest year-on-year house price growth since 2004 in the first half of 2021, with June’s growth (Nationwide) bringing the total growth this far this year to 13.4%

- CBRE forecasts that UK house prices will rise by 5.9% in 2021

- Yields across the UK are compressing. The average prime yield as of May 2021 for all UK property was 5.18%, slightly below the 5.21% recorded in May 2020

The UK Economy

Coming into H2 2021 this report highlights the robustness and resilience of the London real estate market following the Brexit transitionary period and management of the Covid pandemic.

Despite the grim start to 2021 with renewed lockdown restrictions, the economic outlook has brightened with the combination of a newly agreed EU/ UK cooperation agreement and the successful rollout of the vaccination program.

Sterling recovered and is trading in a range of $1.38 to $1.40, about 5% higher than its pre-pandemic level and 20% higher than its value at the time of the first lockdown. Sterling’s recovery, which is forecast to continue modestly, means that import cost pressure will be moderate.

The economic growth projection is now revised upwards by the IMF, now expecting a 7% increase for this year compared with 4.5% back in January. Other forecasts include Oxford Economics consultancy projecting growth of 7.5% to be followed by a further strong performance of 5.5% in 2022.

Activity overall picked up in the UK as confidence in the outlook of the UK economy returns to consumers and businesses. Consumer spending will be the main driver of the initial stage of the recovery, fueled by excess savings built up during the lockdowns, which are estimated to amount around 8% of GDP, around £170 billion.

UK Real Estate

Monthly all-property capital values improved from 0.5% in April to 0.6% in May (JLL, July 2021), driven largely by improvements to retail and industrial, whereas offices values remained stagnant. Similarities are also evident in income returns, where the industrial sector saw rental values grow from 0.5% in April to 0.6% in May (JLL, July 2021). Office rental values remain unchanged.

Improving economic data over the past few months, followed by the reopening of the economy, has helped lift the mood in the real estate sector, with the RICS Commercial Sentiment Index climbing from -25 to -11 in the first half of the year.

Central London Offices

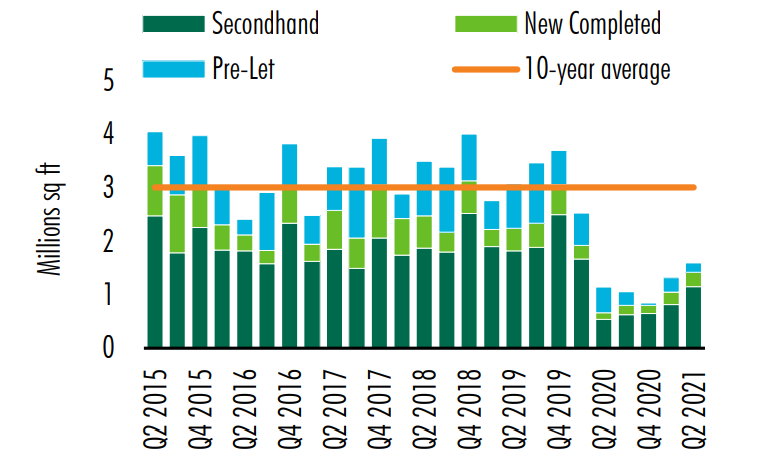

Central London take-up totaled 1.6m sq. ft. in Q2 2021, an increase of 23% quarter-on-quarter although still approximately half the 10-year average of 3m sq. ft. (CBRE, July 2021).

JLL figures for take-up suggest an increase for the quarter by 54% and was dominated by secondhand space which accounted for 72% of all space let (Knight Frank, July 2021). This was driven by transactions in sub-let activity, including three of the five largest deals over the period. Supply however continued to increase over Q2 2021, taking the vacancy rate to 8.1% vs the 10-year average of 5.1%.

Knight Frank reports that prime headline rental rates are still within touching distance of pre-pandemic record high levels, highlighting the resilience of rents for top-quality space, albeit lease incentives continue to increase as landlords experience pressure to rentalise space.

Investment volumes dropped in the office market as investors remain cautious over the outlook for offices as an asset class. Investment volumes in Q2 totaled £3.1bn which is approximately 15% below the 10-year quarterly average of £3.7bn (JLL, 2021). However, year-to-date investment volumes totaled £4.3bn which is still a 40% improvement to the first half of 2020.

JLL reports that investor appetite remains robust with investments targeted across the risk spectrum. Grade A stock and value-add opportunities in core locations remain the most hotly contested.

Central London Retail

As the economy reopens and consumer spending increases the retail sector is starting to see some positive movement.

According to the JLL retail agency team, new lettings continue to be agreed demonstrating increased demand for strong retail locations, also coinciding with a reduction in lease turnovers. Similar to the office market, tenants continue to focus on flexible lease terms.

In the investment markets, there was a 100% increase in shopping centre transactions during the first half of 2021 alone, compared to the whole of 2020, totaling £595m (JLL, 2021). The retail warehousing sector is also picking up interest from institutional investors who were previously net sellers over the last 24 months.

Demand remains strong for grocery/convenience and alternative-use opportunities for smaller lot sizes. There is however a steady stream of tenants being placed into administrations as government support unwinds, a trend which is likely to continue into H2 2021.

Residential Property

This has clearly been a most unusual period for the housing market.

London house prices have climbed up to 6.2% since we first went into lockdown a year ago. While the GDP fell by 19%, the total value of London properties increased during the pandemic to £1.8 trillion.

The housing market has seen the strongest year-on-year house price growth since 2004 in the first half of 2021, with June’s growth (Nationwide) bringing the total growth this far this year to 13.4%.

Transactional activity has also been high in the first half of 2021. According to Avison Young, an estimate of 449,030 UK residential transaction during Q1, the highest since 2005. According to CBRE, there was £771m of residential investment in Q1 2021, with a further £1.5b of deals under offer.

The pandemic has impacted buyers’ preferences, as the price of detached properties in London has increased annually by 5.3%, compared to a 1% increase for flats & maisonettes. Contrary to earlier forecasts of a city exodus, data from Zoopla indicates that the majority of prospective buyers from London are still searching within London in 2021, as was the case for the preceding two years.

An acute supply and demand imbalance, with buyer enquiries significantly outweighing new instruction will underpin price growth to the end of the year. CBRE forecasts that UK house prices will rise by 5.9% in 2021.

Yields

Yields across the UK are trending downwards. The average prime yield as of May 2021 for all UK property was 5.18%, slightly below the 5.21% recorded in May 2020.

| Sector | May-20 | May-21 |

| West End Offices | 3.75% | 3.50% |

| City Offices | 4.00% | 4.00% |

| Offices M25 | 5.25% | 5.50% |

| High Street Retail | 6.00% | 6.75% |

| Shopping Centres | 6.50% | 7.50% |

| London Core Hotels | 4.00% | 3.75% |

Chart 2: Savills, CMIM, June 2021

Prime West End yields compressed as H1 turnover shows strong recovery. Investment volumes in June stood at £277m representing a 25% increase on the equivalent period last year and is anticipated that market sentiment to continually strengthen as we move through H2. City offices and along M25 remained stagnant. Retail yields moved out significantly and interestingly a 25bps compression in Core Hotels.

Summary

London continues to prove its resilience as an international hub for business and investment; the capital’s economy is expected to rebound strongly and with a positive business outlook and a prosperous jobs market, evidenced in the RICS Commercial Sentiment Index. Furthermore, there seems to be a robust adaptation to difficult conditions across the UK, with lockdowns at their most stringent levels in Q1 2021 the fall in UK GDP was much smaller than expected.

Confidence in London’s economy is also evidenced in the Real Estate market overall, where investment volumes are gradually picking up, as is take-up, in the office and retail markets. There is however a shift towards best-in-class real estate or with potential to convert into best-in-class. In addition, the transactional activity and overall performance of the residential market suggests that people are choosing to live and work in the capital.