Executive Summary

The UK Real Estate Report Y2023 offers a summary of significant advancements within the UK real estate industry, providing insights into emerging trends and future forecasts. Additionally, it will delve into in-depth analysis and perspectives on diverse real estate markets.

REAL ESTATE

The real estate sector experienced significant challenges in 2023 due to persistent inflation and a 15-year interest rate peak, which both had a negative impact on economic expansion. This resulted in a sharp decrease in commercial real estate investment volumes, reaching the lowest point in a decade, as investors struggled with diminishing asset values and rising borrowing costs.

However, even though the beginning of 2024 is expected to start the same way due to the recent challenges, there are reasons for optimism. The inflation rate showed a significant decline toward the conclusion of 2023 and is projected to continue a downward path. While the forecasts show that base rates will remain high for an extended period, there is a possibility of rate reductions in Q3 2024. Such reductions would be beneficial for both occupiers and investors, and should stimulate increased activity (CBRE, 2024).

UK COMMERCIAL REAL ESTATE – OFFICES

The office investment market faced significant challenges in 2023 as a result of significant increases in interest rates and the work from home regime. This surge in interest rates caused a repricing of commercial office properties throughout the year 2023. However, is worth noting that in 2023, there was a noticeable shift towards prioritizing quality, as the demand for the top quality, strategically located, and environmentally sustainable buildings exceeded supply (CBRE, 2024).

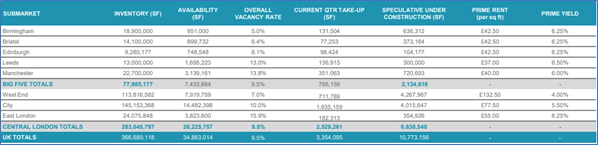

Office Market Statistic

Expected rental growth is anticipated across the key sectors of the UK office markets for 2024. Projections suggest an average annual rental increase of around 3.00% in most UK markets, continuing the strong growth experienced in 2023 (CBRE, 2024).

In 2023, headline rents in most areas reached new highs, and in 2024, this is probably going to happen again. The best-located buildings with outstanding outdoor space access and amenities will witness super-normal rental growth (CBRE, 2024).

UK COMMERCIAL REAL ESTATE – RETAIL

Despite facing challenges from difficult macroeconomic conditions, the retail job market demonstrates resilience. Despite significant streamlining in the sector in recent years, occupiers are taking advantage of adjusted rental rates and persistent vacancies to negotiate favorable terms and secure prime retail locations in new areas. Therefore, prime retail locations are experiencing high levels of interest and substantial leasing activity (Cushman & Wakefield, 2024).

The prime retail investment sector appears to be transitioning into a new stage. Although the overall investment levels are currently modest, there is still a positive outlook for the sector. Anticipated interest rate cuts in 2024 and expected economic recovery in 2025 are anticipated to lead to a substantial rise in investment activity.

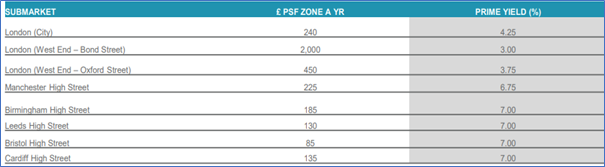

Prime High Street Statistics

Investors are still focusing on prime locations and assets associated with food and consumer goods businesses. These sectors are perceived as more resilient to inflationary pressures and economic downturns, prompting continued interest from investors (Cushman & Wakefield, 2024).

UK RESIDENTIAL PROPERTY MARKET IN 2023/2024

According to J.P. Morgan, despite the decrease in house prices in 2023, they showed signs of stabilizing. While higher mortgage rates have contributed to and continue to cause a decline in prices by reducing consumer borrowing and demand, supply constraints and a tight labor market are preventing prices from dropping significantly (J.P Morgan, 2023).

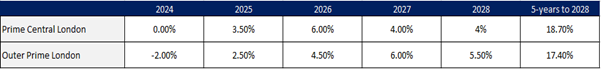

According to Savills latest report, prime capital value forecast shows a -2.0% in outer prime London and a 0.0% in PCL in the upcoming year given the projection that the base rate will persist at its current peak throughout 2024. Nevertheless, as the bank initiates rate cuts in the second half of 2024, a greater potential for growth is expected with a 5-year to 2028 figure at 18.7% for PCL and 17.4% for outer prime London (Savills, 2023).

Prime Capital Value Forecast

According to a survey of property appraisers, London’s home rental costs are starting to drop due to a decline in demand and indications that tenants are not willing to pay market rates for a place to live (Bloomberg, 2023).

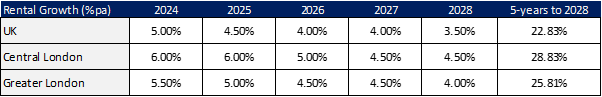

In the coming five years, the shortage of new rental properties, resulting from a decrease in new home constructions and a tougher interest rate climate, is expected to cause rental prices to rise more rapidly than wages. JLL’s predictions indicate a projected increase of 5.0% in rents for the UK, 6.0% for Central London and 5.5% for Greater London in 2024 (JLL, 2023).

From 2024 onwards, JLL forecasts expect that more attractive mortgage rates will result in an increase in tenants moving into owner occupation brining more balance between tenant demand and rental stock.

Conclusion

In conclusion, the UK real estate sector has shown resilience and adaptability in the face of challenging conditions. Despite initial forecasts of economic downturn, prime real estate markets have demonstrated resilience.

Stavros Aristodemou, Senior Investment Analyst, Consulco

Marios Appios, Real Estate Analyst, Consulco

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute a recommendation or solicitation to proceed with any type of investment or investment decision whatsoever. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions based on the content provided herein. While Consulco strives to ensure the accuracy and completeness of the information presented it cannot guarantee the reliability of any information contained in this article and shall not be held liable for any errors, omissions or losses arising from its use. Investments in markets referred to herein involves inherent risks. Past performance is not indicative of future results and there is no guarantee that an opportunity discussed in this article will be successful nor it is endorsed or promoted.