Executive Summary

The United Kingdom’s economic performance in 2023 has shown resilience and adaptability amidst challenging conditions. This report provides an overview of key developments in the UK economy, highlighting trends and forecasts for the coming years. Detailed analysis and insights on business investment, household consumption, inflation and interest rates will be further explored in this report.

THE UK ECONOMY IN 2023/2024

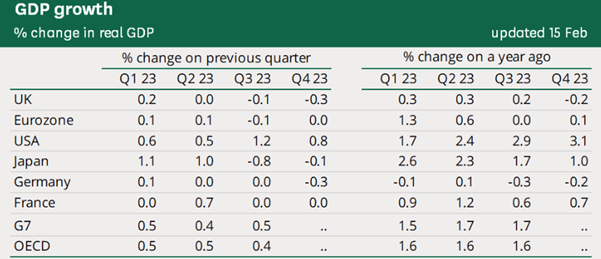

At the start of 2023, market consensus was that GDP would fall by 1% in 2023. GDP at the end of 2023 has increased 0.1% compared to 2022. Experts expects GDP to grow at a modest pace of 0.5% in 2024, and only to pick up towards its steady-state rate of around 1% in 2025.

Year-to-date, business investment experienced a growth of 6.3% in the third quarter of 2023. Although household consumption, typically the primary driver of growth during normal circumstances, increased by 0.3%, it remains below its pre-pandemic levels. This is primarily due to consecutive adverse impacts on real incomes.

Labour market remains tight, as vacancy rates remain at 4% in sectors such as hospitality and healthcare.

UK INFLATION IN 2023/2024

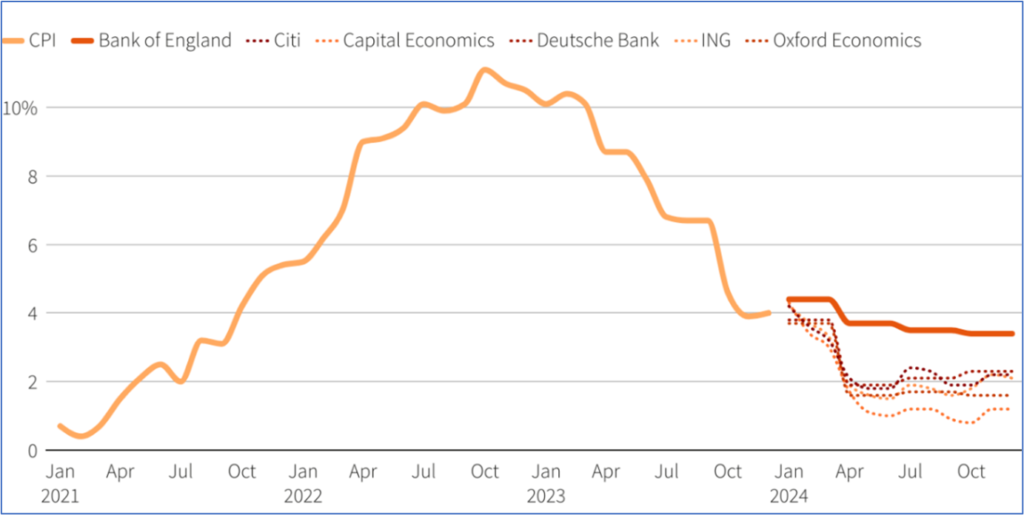

The annual rate of inflation reached 11.1% in October 2022, a 41-year high, before subsequently easing. Inflation has now fallen to 4.00% in December 2023.

The increase of inflation was mainly due to Covid-19, related supply chain disruption and soaring energy and fuel prices, particularly but not exclusively due to the Russian war.

Although the recent disruption to shipping traffic in the Red Sea and Suez Canal resulted in higher shipping costs, the UK’s annual inflation rate is expected to continue falling in 2024. The BoE predicts that inflation will persist above the 2.00% target. Economists on the other hand have cut their forecasts and expect CPI to return to its 2.00% target far sooner than the Bank of England.

Inflation CPI and forecast

January 2024

UK INTEREST RATES IN 2023/2024

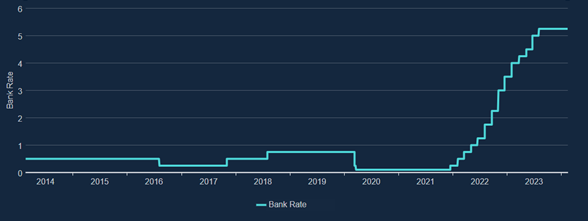

Current Bank of England rate stands at 5.25%.

The Bank of England ended a run of 14 straight hikes in September, after lifting its benchmark rate from 0.1% to a 15-year high of 5.25% between December 2021 and August 2023.

Bank of England Rate

According to the Bank of England, UK average mortgage rates fell for the first time in over two years, which adds to signs of stabilization in the property market as mortgage approvals rose for the third consecutive time to a six-month high in December. Net mortgage approvals for house purchases rose from 51,500 in December to 55,200 in January — the highest reading since June.

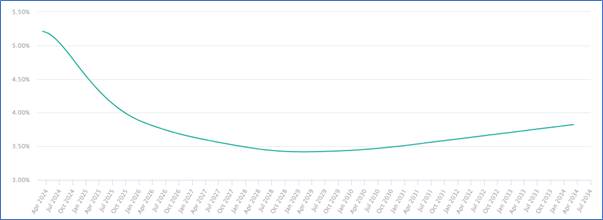

According to the majority of economists, the first cut to Bank Rate won’t come until at least July 2024, with a median prediction for a 25-basis point reduction in the third quarter. The BoE was forecast to reduce Bank Rate by 50 basis points in the fourth quarter, putting it at 4.50% by year-end.

SONIA Forward curve

The financial markets are pricing 4.61% by the end of 2024, 3.91% by the end of 2025 and 3.65% by the end of 2026.

STERLING/EURO IN 2023/2024

The GBP/EUR is currently at 1.1704 which is below the 10-year average at around 1.1791.

The Pound to Euro exchange rate extended the current week’s decline to 1.1708 after the ONS said average earnings, with bonuses included, rose 5.6% in January, which was softer than the 5.7% expected and below December’s 5.8%.

Over the last two years, inflation has emerged as the primary force influencing currency markets. The UK has faced higher inflation compared to the EU, leading the Bank of England to implement more aggressive interest rate hikes than the European Central Bank.

“GBP has been the best performing G10 currency so far in this quarter, but the resilience of sterling will be tested with much of the good news now priced in and wage pressures starting to top out,” says Charu Chanana, Head of FX Strategy at Saxo Bank.

Sterling/Euro Graph

A lower pound leads to increased foreign investment and higher returns on those investments. For foreign investors, a weaker currency in the target country can mean that their investment capital, when converted, yields more in the local currency. In addition, when the currency strengthens, the foreign investor could realise higher returns when converting any profits back into their local currency.

Conclusion

In conclusion, the UK economy has shown resilience and adaptability in the face of challenging conditions. Despite initial forecasts of economic downturn, business investment has surged. However, persistent inflationary pressures and high-interest rates continue to pose challenges.

Looking ahead, the gradual reduction in interest rates and anticipated economic recovery offer optimism for growth and stability in the coming years. Continued monitoring and adaptation to evolving economic trends will be essential for navigating uncertainties and seizing opportunities in the UK market.

Stavros Aristodemou, Senior Investment Analyst, Consulco

Marios Appios, Real Estate Analyst, Consulco

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute a recommendation or solicitation to proceed with any type of investment or investment decision whatsoever. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions based on the content provided herein. While Consulco strives to ensure the accuracy and completeness of the information presented it cannot guarantee the reliability of any information contained in this article and shall not be held liable for any errors, omissions or losses arising from its use. Investments in markets referred to herein involves inherent risks. Past performance is not indicative of future results and there is no guarantee that an opportunity discussed in this article will be successful nor it is endorsed or promoted.