Consulco opens its Limassol office.

Consulco, the investment manager with offices in London, Dubai, Moscow and Nicosia, established its newest office in Limassol. The office is centrally located at 18 Evagora Papachristoforou Street, parallel to Makarios Avenue, near the town’s municipal park. The firm’s Limassol operations are managed by Christos Hadjisotiris and Evangelia Kapnistou, both Limassol bred professionals with considerable experience in […]

Rents in the UK increased by 4.6 percent in the third quarter, the fastest rate in 13 years.

Rental rates are skyrocketing as individuals in the United Kingdom return to normalcy following the Covid-19 outbreak. The average weekly residential rent in London for one- and two-bedroom homes was £566 at the end of October, the highest level since December 2019. According to a research released by Zoopla, the average rent in the United […]

Large Infrastructure projects and their impact on property values.

As London has evolved and grown over the centuries, it has benefitted from waves of infrastructure projects that have boosted economic activity and increased property values. In the eighteen century, the new canal network allowed wool and coal to be shipped more quickly and cheaply to and around the capital, whilst the nineteenth century saw […]

Consulco: Years of experience and knowledge in the field of property and credit funds.

The Group’s long-term goal is to protect and increase our customers’ return on capital, through appropriate structures and investments, and the successful and prudent risk management. “In the current economic and investment environment investors seek alternative investment options whilst applying an important principle: portfolio diversification, risk reduction and high returns, in order to add value […]

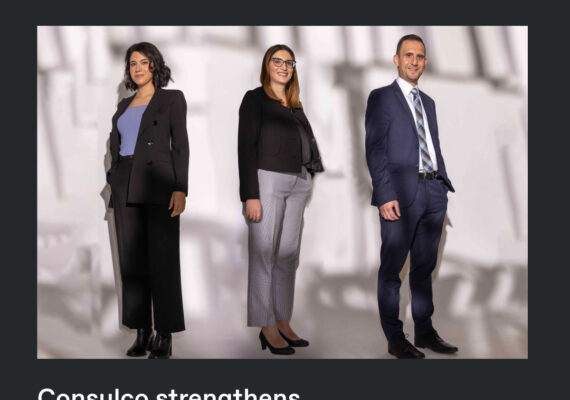

Consulco strengthens its UK investment management team

Consulco has expanded its UK investment management team with the recruitment of three Cypriot professionals with legal and financial backgrounds respectively. Evdokia Georgiou is a chartered accountant by profession and has been working for many years in the finance department of a UK based bank. We are delighted that she has joined Consulco’s London Credit […]